Title insurance companies play a critical role in protecting property owners against title fraud. To further enhance their fraud prevention measures, these companies can leverage biometric identity verification technologies. Facial biometric identity verification utilizes unique physical characteristics to verify an individual’s identity with a high level of accuracy. Here’s how title insurance companies can utilize biometric identity verification to prevent title fraud:

Identity Verification

Biometric identity verification can be used to verify the identities of all parties involved in a property transaction, including buyers, sellers, agents, and attorneys. By capturing biometric data during the verification process, title insurance companies can confirm the authenticity of individuals’ identities and cross-reference the data with trusted databases to ensure they are not using stolen or forged identities.

Prevention of Impersonation

Title fraud often involves impersonation, where fraudsters assume the identity of property owners or authorized individuals to carry out fraudulent transactions. Biometric identity verification can effectively prevent impersonation by requiring individuals to present their biometric data, which is unique to each individual. This ensures that only authorized individuals are involved in the transaction and mitigates the risk of fraudulent transfers.

Secure Storage of Biometric Data

Title insurance companies must prioritize the security and privacy of biometric data. Biometric data should be securely stored and encrypted to prevent unauthorized access or misuse. Companies should comply with relevant data protection regulations and implement robust security measures to protect the biometric information from breaches.

Fraud Detection and Monitoring

Biometric identity verification can be combined with advanced fraud detection algorithms to identify suspicious patterns or anomalies in transactions. By continuously monitoring biometric data and comparing it against established patterns, title insurance companies can quickly identify potential fraud attempts and take appropriate actions to prevent fraudulent transfers.

Collaboration with Government Databases

Title insurance companies can collaborate with government agencies and databases to validate biometric data during the identity verification process. By integrating with trusted sources, such as national biometric databases, title insurance companies can ensure the accuracy and integrity of the biometric data provided by individuals involved in property transactions.

Biometric identity verification offers title insurance companies a powerful tool to prevent title fraud. By leveraging biometric data for authentication, identity verification, and fraud detection, these companies can significantly enhance their fraud prevention measures, ensuring the integrity and security of property transactions.

About This Post:

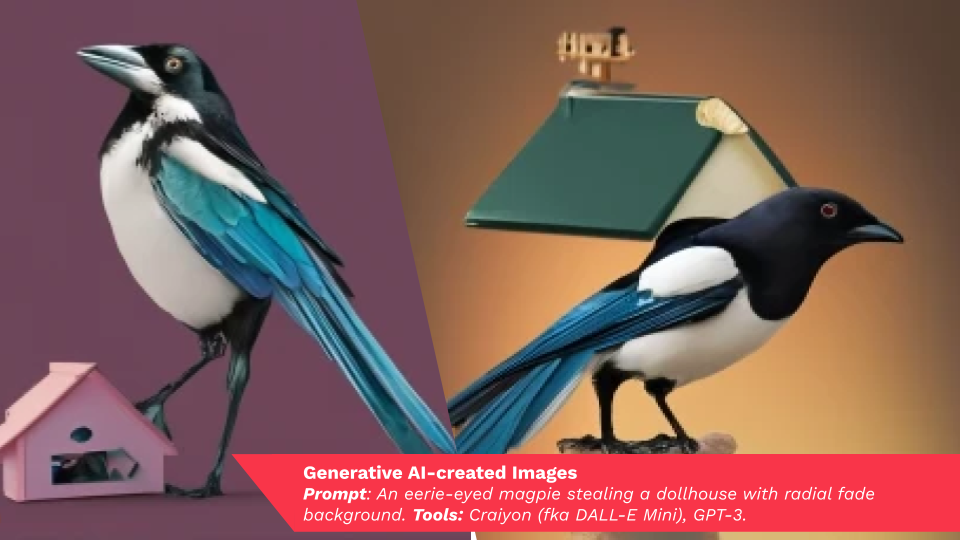

Images are generative AI-created. Prompt: Eerie-eyed magpie stealing a dollhouse with radial fade background. Tools: Craiyon (fka DALL-E Mini), GPT3.