Proof of Address beta

Automated document-based address verification with fraud prevention for utility bill-style documents. Verify a user’s address on a document of any complexity with Natural Language Processing (NLP) technology.

Fully Automated Proof of Address

Verify user’s address faster than humanly possible

100% Automated

Minimize operational costs, remove the burden from manual teams, and accelerate decision-making.

Enhanced Fraud Prevention

Spot a fake or tampered document with an advanced fraud detection that works with any utility-bill-style document.

Full Regulatory Compliance

Ensure adherence to your compliance requirements, such as AML KYC, whilst mitigating financial and reputational risks.

Customer Trust & Data Accuracy

Improve data accuracy, ensure efficient communication, and build trust through commitment to security.

Your customers can simply provide any utility bill-style document—such as a bank statement, water bill, or wireless service invoice—and IDVerse POA can verify their current address in seconds.

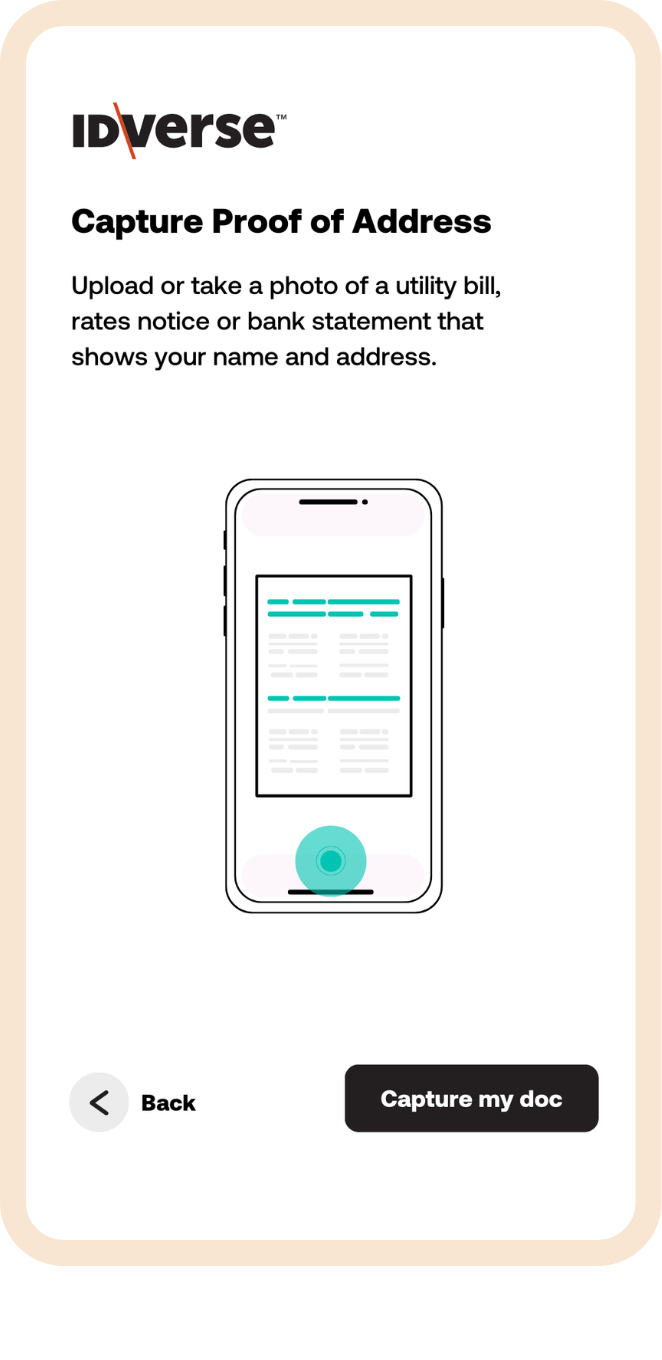

How it works?

Step 1:

Your customer is prompted with clear language to upload or take a picture of any utility bill-style document.

Step 2:

Once done, IDVerse extracts the name, address and most relevant date from the document. All in seconds.

Step 3:

Right after, the user instantly gets redirected back to your platform – right where you want them to continue their journey.

Frequently Asked Questions

By reducing manual labor, minimizing errors, and speeding up the verification process, IDVerse POA helps businesses save time and money, leading to a significant return on investment.

IDVerse POA ensures that your business meets regulatory requirements for address verification, reducing the risk of non-compliance and associated penalties.

Yes, our built-in fraud prevention capability uses advanced algorithms to detect inconsistencies and tampered documents, ensuring every submission is genuine.

IDVerse POA employs advanced OCR technology to precisely extract data from unstructured documents, ensuring high accuracy without the need for predefined templates.

Our POA solution accepts all types of utility-bill-style documents that include a name and address (e.g. mobile phone bill, water or electricity bill, bank statement, etc.), ensuring flexibility and comprehensive coverage.

Common use cases include customer onboarding, KYC compliance, fraud prevention, and maintaining accurate customer records in industries like financial services, gaming, and telco.

Yes, IDVerse POA is designed to process large volumes of verifications efficiently, even during peak times, ensuring consistent performance.

IDVerse POA is designed to seamlessly integrate with your existing systems through APIs, ensuring a smooth and hassle-free implementation process.

Yes, IDVerse POA offers configurable solutions tailored to meet the specific regulatory and operational needs of various industries, including financial services and iGaming.

To get started, you can sign up for our beta program or contact our sales team for more information on integrating IDVerse POA into your business.