Our Mission

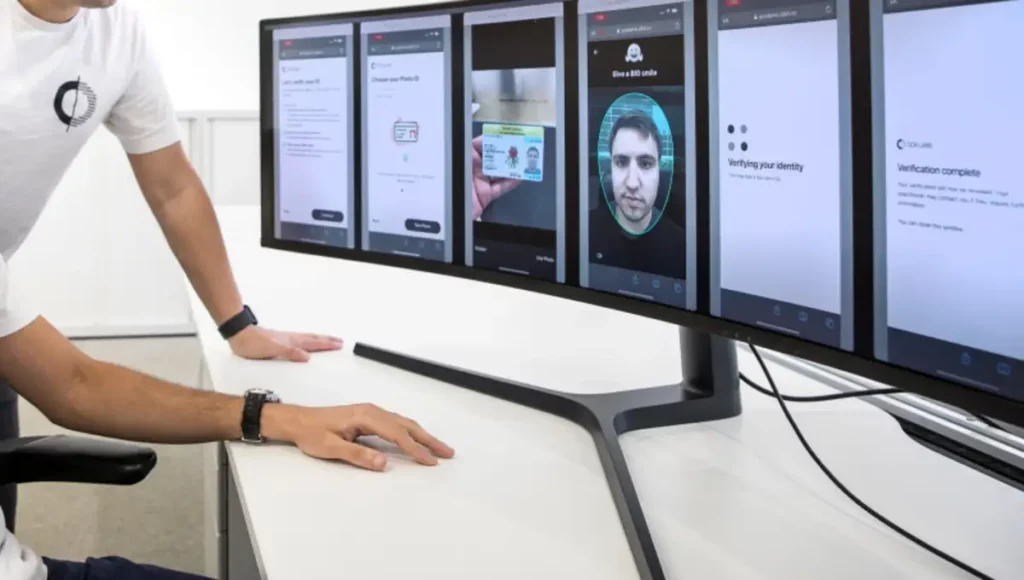

IDVerse is focused on making user verification effortless through technology. We build intelligent tools that protect users from identity fraud while enabling a seamless user experience.

We’re focused on removing the burden of identity verification for our customers so you can focus on scaling your business without the compliance and operational overheads.

About IDVerse

Frustrated by authentication solutions that didn’t do what they claimed, we set out to develop an identity verification solution ourselves, from scratch.

We spent five years building our own end-to-end ID verification solution in our dedicated laboratories, before launching it in late 2018.

We’re a team of 150+ all focused on one mission—making user verification effortless. It’s our diversity of backgrounds, skills, and experience which allows us to build the future of identity verification.

We have offices in the UK, the US, Turkey, Australia with more opening soon. Join us at upcoming Events.

Our Customers

We work with businesses of every size, from startups to enterprise. We’ve partnered with future-focused businesses including: Westpac, ANZ, Vodafone, HSBC, Virgin Money, and BMW.

Building a Diverse and Inclusive Workforce

At IDVerse we believe in the inherent strengths of a vibrant, diverse and inclusive workforce. Our different backgrounds, perspectives and life experiences assist IDVerse in building lasting connections with our people and clients. We believe in empowering the potential in everyone.

Accessibility is part of who we are. We are proud to be an equal opportunity employer and we value diversity. We do not discriminate on the basis of educational attainment, race, religion, color, national origin, gender, sexual orientation, age, marital status, veteran status or disability status—simply, we consider all qualified applicants, consistent with any legal requirements. If you have a disability or special need that requires accommodation, please let us know.