Forefront Events hosted the Fraud Prevention and Detection Melbourne event in June 2023, bringing together 130+ fraud prevention professionals across industries. Here are some key takeaways from thought-provoking sessions on topics like predictive behaviours to prevent fraud, tech to detect fraud, identity verification without bias, and how Tony Sales, “Britain’s greatest fraudster,” redeemed himself from deception.

That’s right: Tony Sales, author of The Big Con, dialed into the conference to provide us with an insightful session on his journey and how he’s helping organisations understand how to predict fraud attacks based on his own experience doing the act.

Key takeaways

Collaborate brazenly to combat fraud

A powerhouse panel discussion, moderated by Feedzai and which included executive investigations and fraud specialists from ANZ Bank, Services Australia, and Country Road, explained that when various stakeholders come together and share the best practices, we will truly get closer to resolving the challenge of identity fraud.

This event provided a forum for collaboration and the continued collective effort that is needed to protect consumers and digital businesses from ever-evolving attacks, demonstrating that the force is strong.

Tech is a tool to assist fraud: “You don’t see a computer in jail.”

Tony Sales, Author of The Big Con: How I Stole £30 Million and Got Away With It, shared interesting insights into how a fraud criminal’s mind works. He explained that it is like continuous learning for them. They are smart, and in today’s tech world, these criminals learn quickly to know how your business operates to find vulnerabilities, allowing them to quickly dive in to access the “valuables,” i.e. your data. He claims there are lots of tech tools out there to assist, noting that computers only assist in the crime: “You don’t see a computer in jail, do you?”

“Human’s do the criminal bit,” Sales said. “The computer is just a tool to help them commit the crime.”

As a reformed fraudster, Tony partners with global banks to help them identify and understand predictive behaviours of fraudulent transactions, allowing them to stay ahead of the next attack.

The quest for Zero Bias AI in IDV

AI has emerged as a great tool to prevent fraud in the assistance of IDV. As identity professionals looking ahead to the future, we must prioritise inclusion and building identity systems that work for everyone. Ensuring that biometric and document verification technologies work effectively for users regardless of race, ethnicity, sex, gender identity, age, national origin, or disability is essential for modern businesses.

Paul Warren-Tape’s session on “The Intersection Between Human, Ethics, and AI” highlighted that we must overcome 4 key areas of bias:

1. System bias

If an identity verification (IDV) solution only works on the latest smartphone model with a superior camera spec or with a high speed internet connection, then any users who do not meet these requirements will be forced to rely on manual methods of verification or be excluded from accessing a service altogether.

2. Data bias

If biased data is used to train AI, it is likely the system will exhibit those same biases when making decisions. This has become the AI industry’s Achilles heel. Advancements in generative AI, also known as synthetic media, combined with ethically-sourced synthetic datasets for training shows that developers are using this tech to make their products better.

3. Manual screening bias

Automated identity verification systems that are available 24/7/365 and require no manual human intervention are far more inclusive to a wider customer base. For example, offering account opening services during business operating hours, when human analysts are available, excludes low-income customers who cannot afford to take time off of work, or those who work night or weekend shifts.

4. Language bias

It’s no secret that the onboarding process represents a major hurdle for businesses. Users are prepared to drop off if this stage is too difficult or can’t be completed. Removing the barriers that prevent users from comprehending the actions they need to successfully advance through each stage will require catering to a range of accessibility needs.

IDV solutions which support more writing systems, more languages, and more document types will allow businesses to reach more customers. In short, the quest for Zero Bias AI in IDV is for anyone, anywhere, anytime.

Thanks to the fraud community for coming together and spending time deliberating on this important issue that touches each one of us in some or other way.

Want to join the quest for zero bias AI? Download the report to learn more.

About the post:

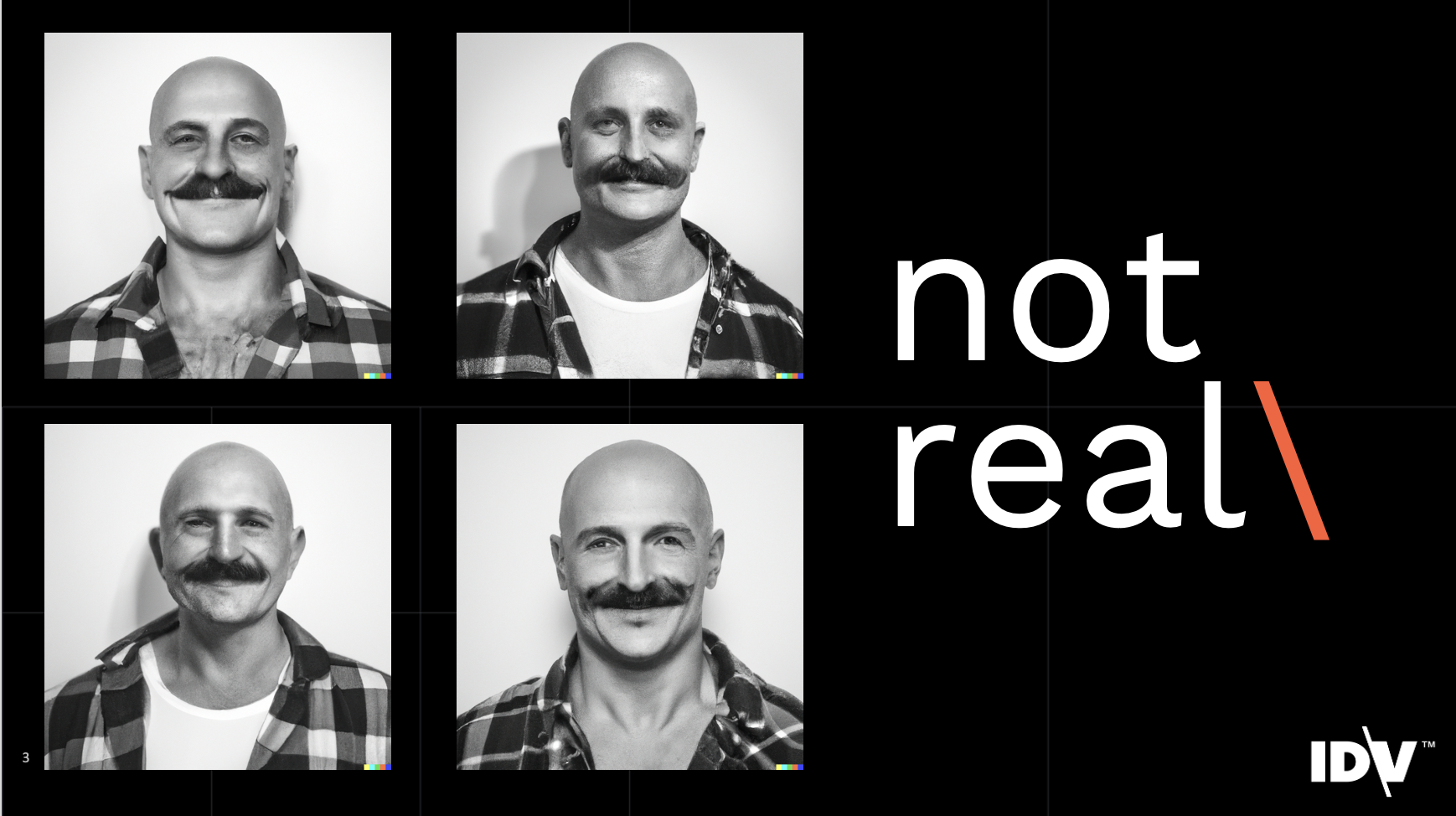

Images are generative AI-created. Tool: DALL-E.

About the author:

Natalie Mendes is IDVerse’s Head of Marketing for the APAC region. She oversees the company’s go-to-market plans and works closely with clients to bring IDVerse thought leaders and IDV tech to the community. Mendes has served in a variety of roles across a range of sectors including data science, analytical marketing, and advanced analytics.