Ensuring the authenticity of users safeguards against fraudulent activities. Identity validation serves as the first line of defense—and to achieve foolproof security, it employs a layered approach encompassing 5 key functions.

The second post in this 3-part series delves into these crucial functions, highlighting how they work in tandem to assess whether an identity is genuine or potentially fraudulent.

1. Document authentication engines

At the core of identity verification lies the need to confirm the authenticity of presented ID documents. Documentation authentication plays a pivotal role in this identity proofing process, utilizing advanced algorithms to scrutinize government-issued documents for signs of tampering, alterations, or forgeries.

By analyzing various security features embedded in government-issued IDs, such as watermarks, holograms, and microprinting, these engines can detect discrepancies that might indicate fraudulent attempts.

2. Data attribute validation

Beyond confirming the legitimacy of the ID itself, validating the data attributes on the presented ID is equally essential for both data quality and an added layer of fraud prevention. This step involves cross-referencing the information extracted from the ID against reliable authoritative data sources or government databases.

Ensuring that the data is accurate, up-to-date, and consistent with the government records provides an additional level of confidence in the identity verification process.

3. Liveness assurance

Ensuring you are interacting with a real person is a critical aspect of remote identity verification. Liveness assurance utilizes cutting-edge technologies to verify that the person presenting the ID is physically present and not a static image, video, or another person wearing a lifelike mask. (Yes, fraud is actually perpetrated in this manner sometimes.)

When the system requires real-time interactions during the verification process, it can detect and deter potential fraudsters attempting to use stolen or fake identities.

4. Biometric face matching

To establish that the individual presenting the ID is indeed the rightful owner, biometric face matching plays a pivotal role. This function leverages biometric data stored during the initial identity registration process to compare and confirm the person’s facial features against the stored template.

The high accuracy and reliability of biometric face matching significantly enhances the overall security of the validation process while stopping fraudsters at the front door

5. Real-time transaction validation

Completing the identity validation process in real-time is essential for seamless and secure interactions. Why? Ensuring that the transaction is happening right at the moment of verification adds an extra layer of protection against potential attempts at using previously obtained identities.

Real-time validation ensures that the identity being presented is currently valid and has not been flagged as suspicious or revoked since the initial registration.

As easy as 1-2-3-4-5

Identity validation is a multi-faceted process, encompassing five key functions that work harmoniously to distinguish authentic users from potential fraudsters. By deploying advanced technologies like document authentication, data attribute validation, liveness assurance, biometric face matching, and real-time transaction validation, organizations can establish robust security measures.

This layered approach not only fortifies against identity fraud but also enables smooth and secure interactions for users worldwide. Embracing these key functions ensures that the digital landscape remains a safe and trusted environment for everyone.

About the post:

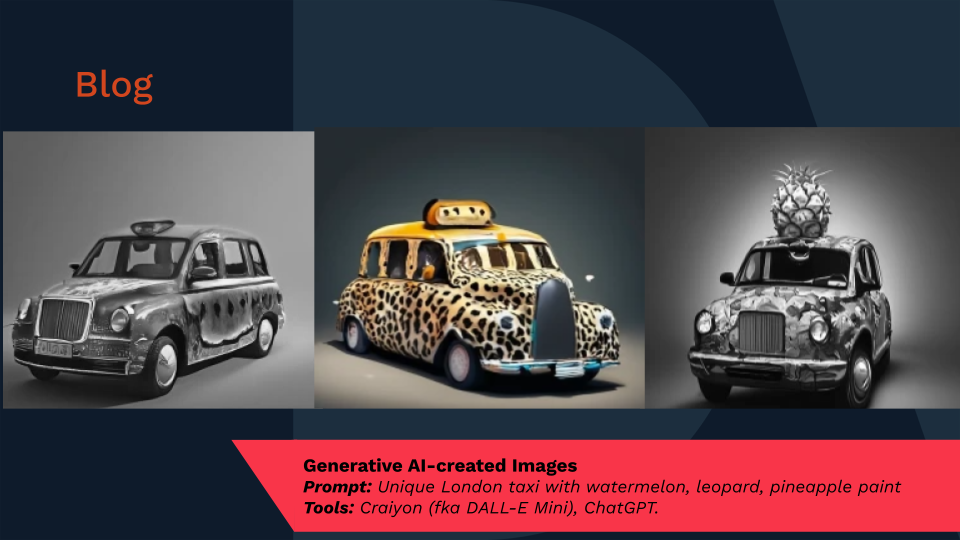

Images are AI-created. Prompt: Unique London taxi with watermelon, leopard, pineapple paint. Tool: Craiyon (fka DALL-E Mini), ChatGPT.

About the author:

Paul Warren-Tape is IDVerse’s GM for the APAC region. He has 20+ years of global experience in governance, operational risk, privacy, and compliance, spending the last 10 years in pivotal roles within the Australian financial services industry. Warren-Tape is passionate about helping organisations solve complex problems and drive innovation through encouraging new ideas and approaches, whilst meeting their legislative requirements.