Identity verification (IDV) is crucial for modern businesses—yet many organizations struggle to measure its impact accurately. Some are unaware of the full costs involved.

To address these issues, we’ve developed the Return on Identity™ (ROI) Framework.

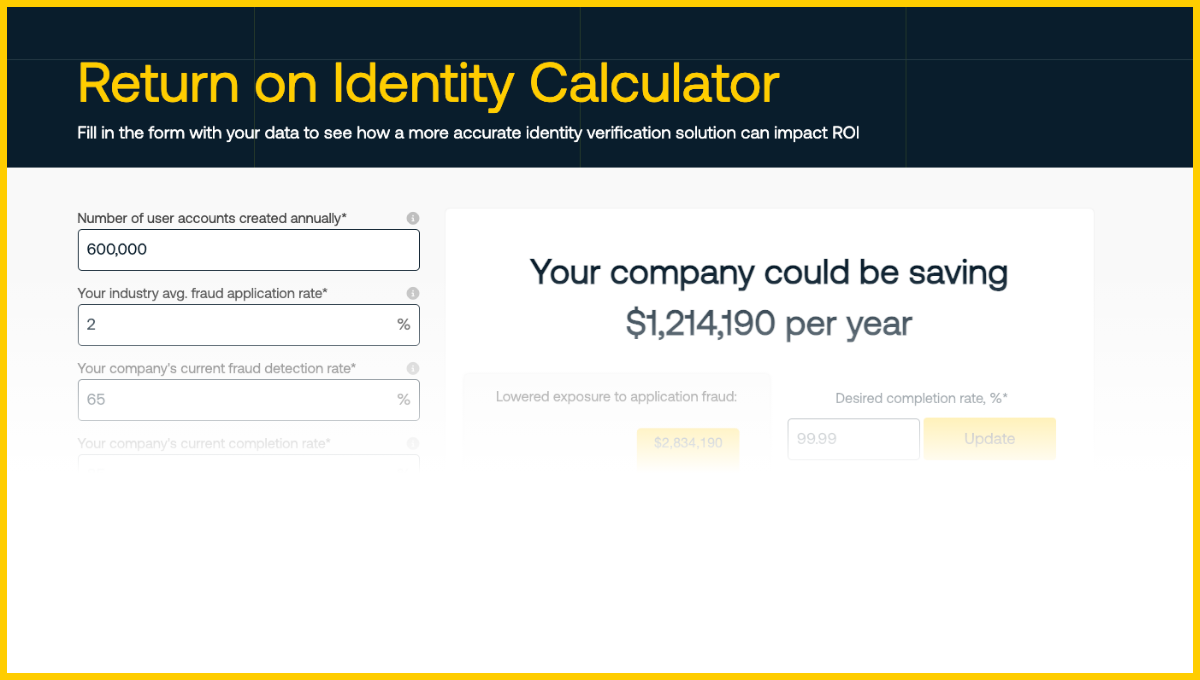

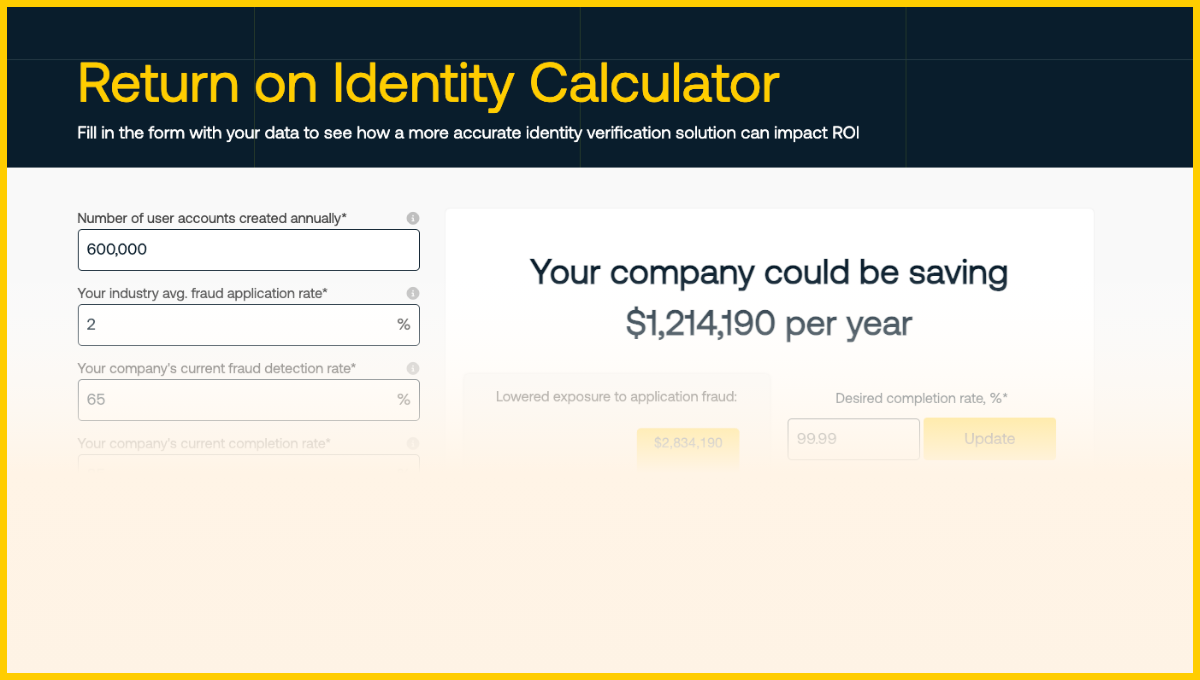

Understand the cost of fraud with the Return on Identity Calculator

This methodology helps businesses quantify both financial and operational impacts of IDV solutions. It focuses on key metrics influencing business performance, showing how these technologies can reduce fraud, improve customer acquisition, and enhance onboarding experiences.

The ROI Framework examines direct and indirect benefits of enhanced identity solutions, enabling organizations to make informed decisions about their strategies and investments. Below, we’ll explore the framework’s components and dissect its methodology in greater detail.

Here’s a rewritten version in a more formal white paper tone:

Why use the Return on Identity™ Framework?

The framework offers several key advantages for organizations seeking to evaluate their identity verification solutions:

- Holistic assessment: The ROI Framework integrates fraud reduction metrics with customer acquisition data, delivering a comprehensive analysis of the value generated by identity solutions.

- Financial justification: A structured methodology to calculate financial returns supports data-driven investment decisions in identity verification technologies.

- Actionable insights: Quantification of benefits such as decreased fraud exposure and enhanced process accuracy allows organizations to implement strategic improvements to their identity management processes.

This methodology enables businesses to evaluate identity solutions through concrete financial and operational metrics. Consequently, it facilitates more informed decision-making regarding investments in identity verification technologies.

Framework variables & definitions

The Return on Identity Framework utilizes several key variables to assess the impact of identity verification solutions. These variables provide a comprehensive view of both the financial and operational aspects of implementing such technologies:

1. New Accounts Created Annually

Measures business growth in terms of customer acquisition.

- Definition: The total number of new customer accounts generated each year. This metric helps measure business expansion or the efficiency of systems that facilitate customer enrollment and acquisition.

- Formula: Total new accounts per year after the solution is implemented.

- Impact: More new accounts translate into increased revenue, especially when customer onboarding is optimized through improved identity verification processes.

2. Industry Fraud Application Percentage

Benchmark for assessing fraud risk.

- Definition: The proportion of total submitted applications deemed fraudulent, based on industry standards or external reports. This percentage provides a benchmark for assessing a company’s risk of fraudulent applications relative to industry norms.

- Formula: Fraudulent applications (industry) ÷ total applications (industry).

- Impact: This sets the context for the fraud risk faced by the business, enabling comparisons between the company’s performance and industry standards.

3. Pre-Solution Fraud Detection Rate

Baseline fraud detection capability before the new solution.

- Definition: The percentage of fraudulent accounts identified and stopped before the adoption of a new solution. This baseline metric is used to compare fraud detection capabilities before and after the implementation of the technology.

- Formula: Fraudulent accounts detected pre-solution ÷ total fraudulent accounts.

- Impact: This establishes a baseline to measure improvements in fraud detection after the identity solution is adopted.

4. Process Accuracy Rate

Measures the reliability and precision of identity verification processes.

- Definition: The percentage of error-free or successful outcomes in a given process, such as fraud detection or identity verification. A higher accuracy rate indicates a more reliable system with fewer mistakes or inefficiencies.

- Formula: Accurate verifications ÷ total verifications.

- Impact: Higher accuracy reduces costs associated with manual reviews, error resolution, and customer dissatisfaction.

5. Average Loss per Fraudulent Account

Quantifies the financial impact of undetected fraud.

- Definition: The average financial impact of each fraudulent account on the business, including direct financial losses and associated costs like recovery efforts or reputational harm.

- Formula: Total loss from fraud ÷ number of fraudulent accounts.

- Impact: Reducing fraud lowers financial losses, improving bottom-line profitability.

6. Reduced Fraud Risk in Applications

Reduction in fraud exposure post-solution.

- Definition: The decrease in the business’s exposure to fraudulent applications after implementing a new solution. This measures the effectiveness of the solution in lowering the frequency or impact of fraud, thereby reducing financial and operational risks.

- Formula: Fraudulent applications post-solution ÷ total applications post-solution.

- Impact: As fraud risk decreases, the organization saves on fraud-related costs and improves the overall trustworthiness of its customer base.

Methodology for using the Return on Identity™ Framework

The framework offers a structured approach to quantifying the return on investment for identity solutions. This step-by-step methodology primarily focuses on the impact of these solutions on fraud reduction and customer growth.

1. Data Collection

Initial data gathering encompasses baseline metrics for six key variables prior to the implementation of a new identity solution:

- Annual new account creation volume

- Industry-standard fraudulent application rates

- Pre-solution fraud detection efficacy

- Current identity verification process accuracy

- Average financial loss per fraudulent account

2. Identity Solution Implementation

Deploy the selected identity verification technology, ensuring its configuration aligns with objectives for fraud exposure reduction and customer onboarding optimization.

3. Post-Solution Data Collection

Following implementation, collect updated data for the six variables, with particular attention to:

- Variations in annual account creation

- Revised fraud detection rates

- Enhancements in process accuracy

- Reductions in financial losses per fraudulent account

- Decreased exposure to application fraud

4. Financial Impact Quantification

- Revenue increase: Assess additional revenue generated from improved onboarding processes.

- Cost reduction: Evaluate savings from decreased fraudulent activity, operational error reduction, and minimized manual intervention.

- Risk mitigation: Analyze the solution’s impact on future risk exposure by comparing pre- and post-solution fraud rates

5. Return on Identity Calculation

Apply the ROI formula:

Benefits encompass increased new accounts, reduced fraud losses, and lower operational costs from improved accuracy. Costs include initial implementation, training, and ongoing operational expenses.

6. Results Interpretation

- A positive ROI indicates the identity solution provides financial benefit, justifying the investment.

- Utilize these results to inform future decision-making regarding investments in identity verification technologies or process optimizations.

This methodical approach enables organizations to make data-driven decisions about their identity verification strategies, ensuring alignment with both financial and operational objectives.

About the author:

Jarrod Basger is Managing Director (UK & EMEA) at Jefferson Capital Growth Partners, a family office providing growth capital, custodianship, and hands-on expertise to strong business founders. Based in London, he actively works alongside founders to support their growth and success, offering specialist support in areas such as sales & marketing, operations, corporate governance, financial management, and M&A.